Powerful Film Business Plans

All the components investors need

We Provide:

Everything producers need for successful fundraising. Including a suite of proprietary and crucial business plan elements: buy only the elements you need, or we will craft a custom business plan for you. Whether you are a low-budget first-timer or an extremely experienced producer, distributor or financier, we have significant experience and can help you. Check out some of our services below.

What Our Clients Say:

Jeff Hardy, and the entire team at FilmProfit, is simply fantastic at providing not only presentation materials to aid us in raising funds, but doing so in a contextual manner. They're always available to spend any amount of time discussing different ways to analyze data, and they're happy to give suggestions. That said, we, and our investors, always know that the data we get will be beyond reproach. Always sound, and backed by meaningful research. Scott Mitchell Rosenberg, Platinum Studios. www.platinumuniverse.net

We, And Our Investors, Always Know That The Data We Get Will Be Beyond Reproach.

Platinum Universe

I have worked in film finance for over twenty years and Jeffrey’s understanding of the industry and ability to research and keep up to date on all trends is exceptional, which is exactly why the studios rely on him for his expertise on global ROI’s. I will always run every production with FilmProfit, it is the best money you can spend to protect your investors. Belle Avery, Producer, The Meg

It is the Best Money You Can Spend to Protect Your Investors.

Apelles EntertainmentI Have Used Filmprofit's Services For Many Projects. I am constantly amazed at the depth of information that gets put into the packages that your company prepares. The best thing about the work is how thoroughly detailed the information is, and how visually oriented the data is. My company has been utilizing FilmProfit's services for many years now, not only for our own company's needs, but for our client’s projects as well. I have used other analytics services in the past, but since I found this company I have not even considered going anywhere else. Ray Ellingsen

I Have Used FilmProfit’s Services For Many Projects.

Moving Pictures Media Group

Anyone serious about impressing their investors should be using FilmProfit. The most comprehensive revenue and cash flow report I've seen. Michael Wiese, Author of Film and Video Financing

Anyone Serious About Impressing Their Investors Should Be Using FilmProfit

Michael Wiese Productions

With the great help of your thorough and well-researched financial data, I have raised $5.6 million in production funding from private investors, and I am currently using your data to raise an additional $7 million for new features. Mark Stouffer, Dog Gone, Creatures of Darkness

The Great Help Of Your Thorough And Well-Researched Financial Data

Mark Stouffer Productions

My experience with filmprofit has been spectacular I've gone through the process 4 times now, and each time has been a wonderful experience. Working with Jeff on the current market trends, various financial and distribution models, and social media impact of films is something that would be of benefit to every filmmaker. The overwhelming data that is present in each film's proposal has a major impact on obtaining both financing and distribution. Film Profit has my absolute highest recommendation and endorsement on every level. Gregory Pellerito, Jackpot Pictures

My Experience With FilmProfit Has Been Spectacular

Jackpot Pictures

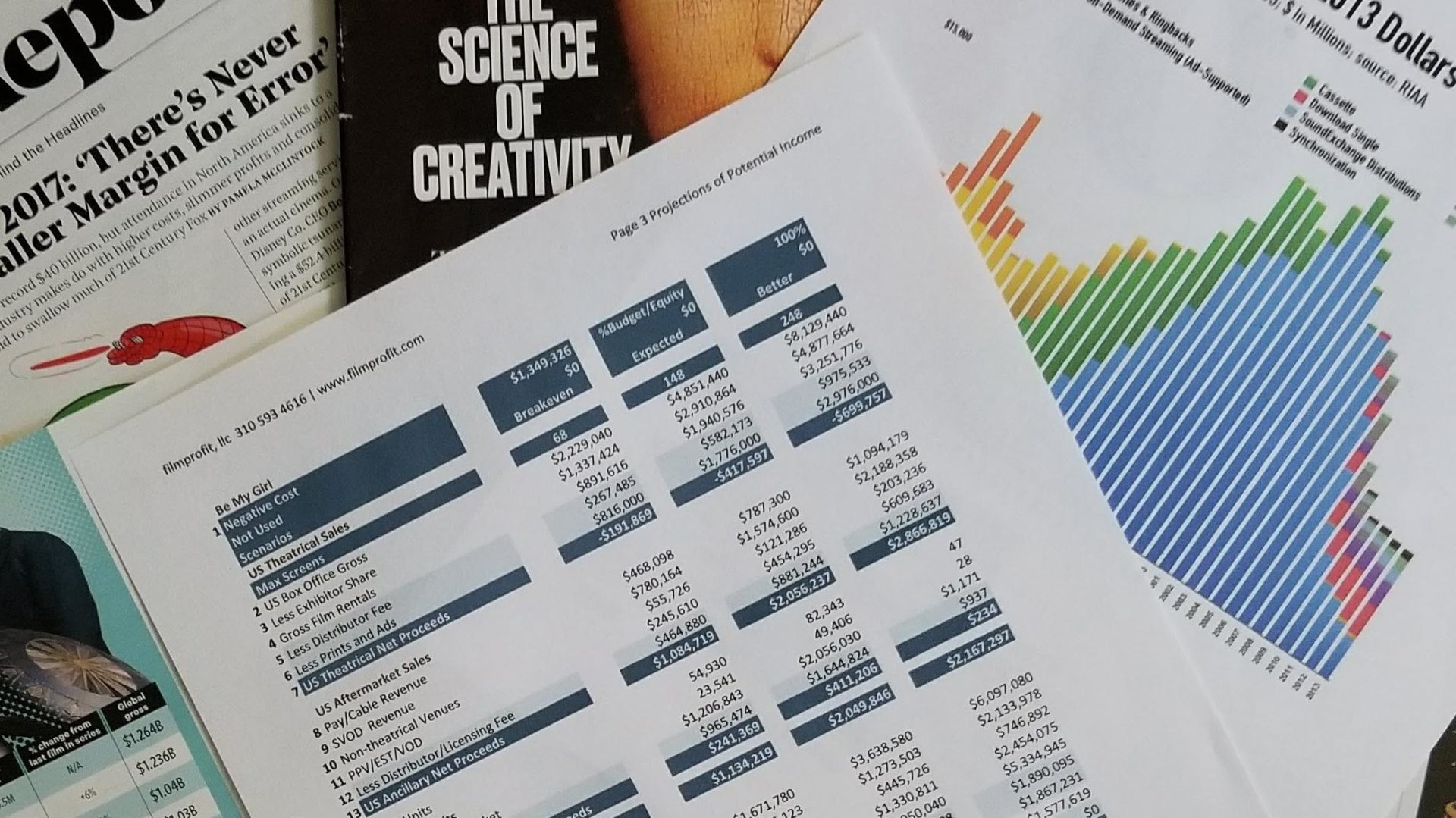

There is so much to love in our proposal It is very thorough, leaves no unanswered questions about our target audience and demographics. The Project Projections is our favorite section. The low, medium and high projections are exciting to see and are an awesome guide for any investor. Our project is different than most. It's a time travel comedy that has original hip hop and rock and roll music. We thank you for doing additional research to assist us. We couldn't be happier with your work and support. It lets us know that you understand the type of film we want to make and the audience we want to attract.

There Is So Much To Love In Our Proposal

Hip Flop Movie

It is the best business plan for a movie or movies I have ever seen in my life. Except, only, the business plan for Disney's Silver Screen Partners." Patrick Wells, Producer, I Love You to Death, Youngblood, The Personals, At Jesus' Side

It Is The Best Business Plan For A Movie Or Movies

FilmProfit was a pleasure to work with. They created a business plan that helped make the case why my film should get funding and distribution. Without it, there is no way the movie would be where it is today. Koji Steven Sakai, Writer/Producer, Santa Vs. Zombies, www.santavszombiesfilm.com/

They Created A Business Plan That Helped Make The Case…

Santa Vs. ZombiesThe discussions with you focused our thought process on ratings and the audiences we could expect with either an R or PG13. The thoroughness of the report makes it a plus for investors to see. The report reinforced important aspects of the project and gave us confidence. Frank J. MaMana Producer/Director, Eerie Hollow Post Industrial Pictures

The Report Reinforced Important Aspects Of The Project And Gave Us Confidence

Post Industrial Pictures